US SEC vs Ripple Labs, LLC (Update)

What Will The "Ripple Effect" Be When All Is Said And Done?

The never ending “battle” between the US SEC and Ripple Labs, LLC appears to be coming to a close. More plainly stated, the stage curtains appear to be ready to close on this incredible performance by all involved. Will the participants receive a standing ovation when the final curtain drops?

The primary question at hand is this. Will Ripple’s XRP become the first cryptocurrency with regulatory clarity? Has this prolonged legal affair with the SEC been just a cover story, allowing banks in the US and central banks around the world to quietly gather XRP while the price of XRP is suppressed by all of this regulatory mishmash? Will the world’s bridge currency soon emerge, changing the global financial landscape forever?

Here is what the court case schedule looked like during the month of May.

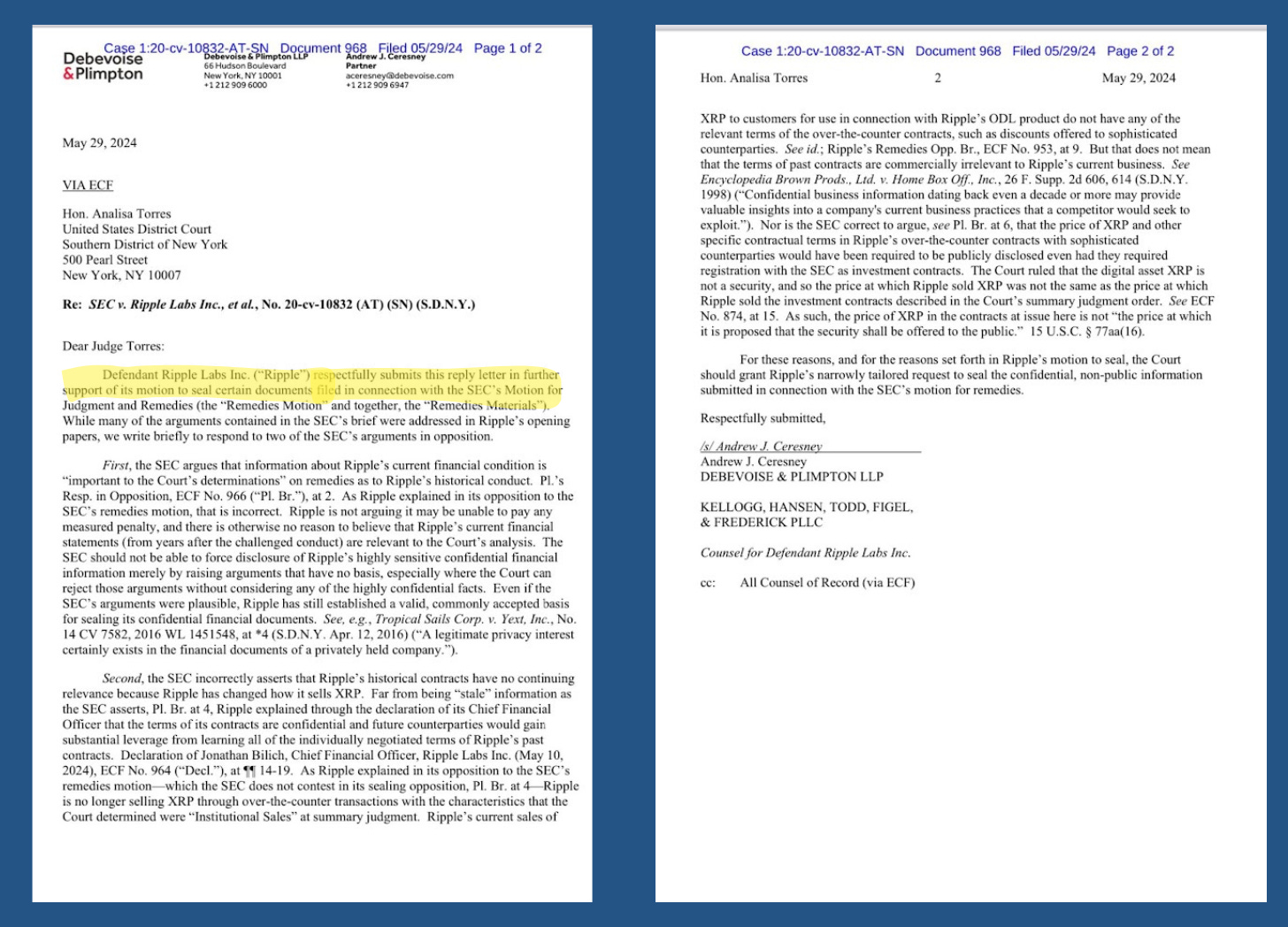

The SEC did file a response to Ripple’s motion to seal on 5/20. We are sharing pages 3-6 of that filing here.

We are guessing that the final “settlement” agreement between the SEC and Ripple will ultimately be sealed as both parties seem to be in agreement on that. In its latest filing on 5/29/24, Ripple stated that it was in support of the sealing of certain documents, but Ripple did want to clarify some final details.

Boring, right? Who cares? Yawn, yawn? Actually, you are beyond wise if you can throw off the temptation to dismiss this story as being irrelevant. Once a person understands that there is a major financial transformation playing out globally, all things financial suddenly become quite riveting.

For now, we wait for Judge Torres to issue her ruling in the case, which is likely to come in the next 3 months. Of course, a settlement could be reached at any time now. As always, the case is nothing more than a waiting game.

We have no idea if this information pertains to this story, but we thought it was worth sharing to get a feel for other things that are happening at the SEC.

It is also good to remember the timelines here. Meetings between the SEC and Ripple date all the way back to 8/20/18. We are approaching 6 years of legal drama.

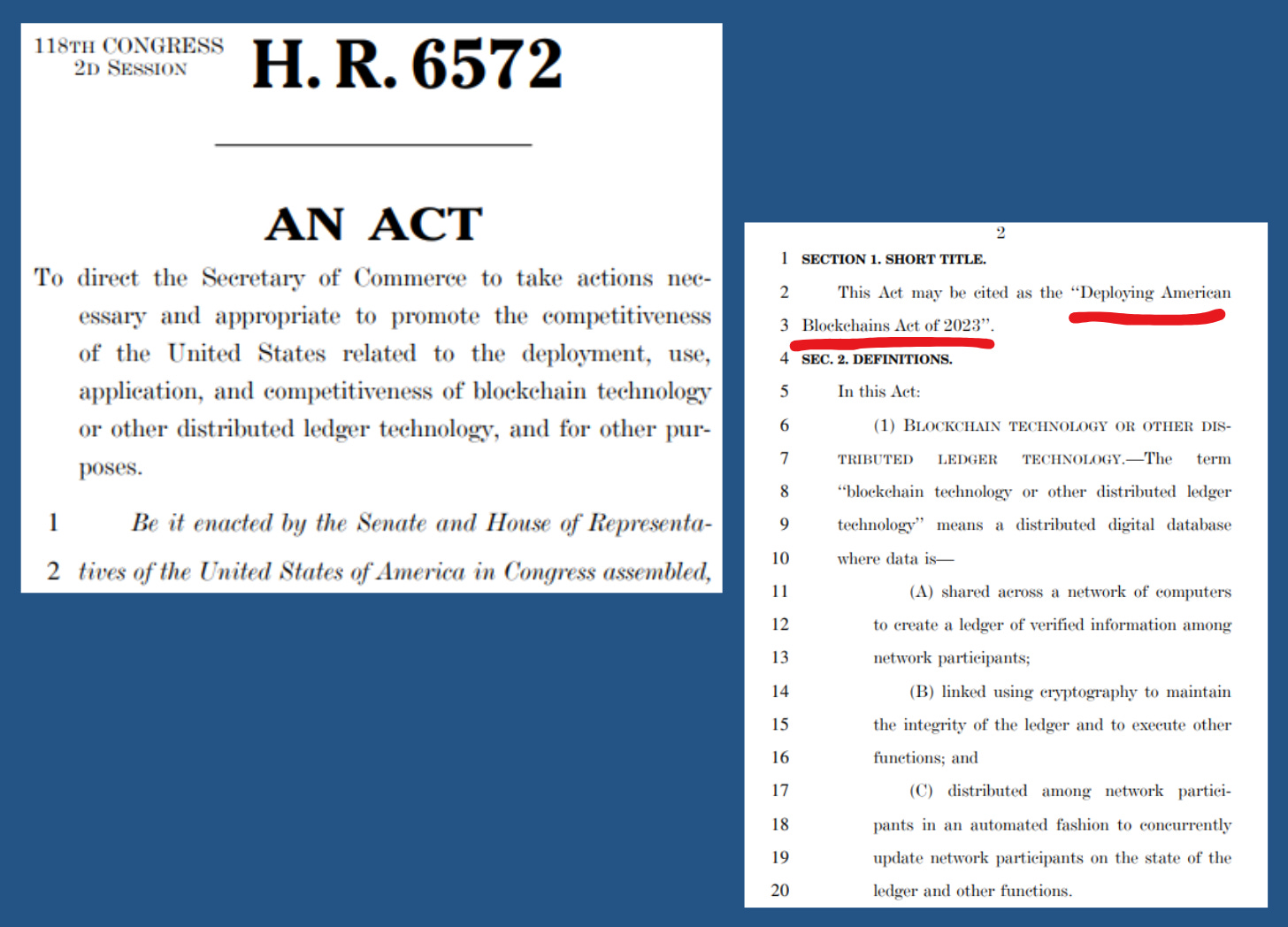

While this slow, drawn out court case appears to be inching towards a conclusion, this happened. The Deploying Americans Blockchains Act of 2023 or H.R. 6572 passed, giving the Secretary of Commerce, Gina Raimondo control over all crypto.

In other words, does H.R. 6572 nullify any oversight that the SEC thought they may have had over Ripple XRP?

Again, what exactly is being accomplished by such a long, drawn out, boring, regulatory, legal process placing Ripple up against the SEC for months and months? As stated multiple times, this case has been moving forward at a snail’s pace, but very methodically and for all the world to see. Some financial analysts, including members of our team, believe that this entire drawn out, boring case has had but one purpose. It has allowed central banks and financial institutions to quietly gather large sums of XRP while the price is suppressed by the stern regulatory stranglehold, perceived or real, being placed on it by the SEC. At the end of the day, we can neither confirm or deny this claim.

So rather than ending this post right here on speculation, let’s explore. What else do we know about Ripple XRP? Are there any indicators that XRP will be used by other countries? Is XRP’s development expanding or contracting?

We will limit ourselves to 10 indicators or other happenings that our team thought would be worth noting here. Please know that there are many more for those of you interested in digging further.

#1 Japan has indicated that all of their banks will utilize XRP as of 2025. More plainly stated, the world is NOT waiting on the SEC vs Ripple court case ruling.

#2 BRICS nations, now 11 countries strong with 30-40 countries scheduled to join BRICS in 2024, have indicated that they plan to use their own currency. Now how could that possibly work? Well, we simply know that the BRICS currency will definitely NOT be the US dollar. And if each nation uses its “own” currency, then a global exchange currency (XRP) or bridge currency would be required.

#3 Banks across the world are equipped and ready to use XRP. Per Ripple’s CEO Brad Garlinghouse, they have publicly disclosed the long list of banks that are ready to utilize XRP and even went so far as to say that the list of partnering banks is not fully disclosed. Translation: There are hundreds of banks across the globe standing in the ready position to implement the use of XRP.

#4 Ripple became a member of MSBA in 2019, which is a detail that may become important to know later. We will leave it as a mysterious, stand alone fact for the time being.

#5 FINRA settlement rules changed as of May 28 moving from T+2 to T+1 for trades. Should this be considered a substantial shift or just more financial mumble jumbo? Well, things just starting moving much faster. It is certainly interesting timing for the FINRA settlement changes to be occurring. To refresh, XRP settlement speeds are dominant. “Settlement = #XRP” is 100% correct.

#6 Ripple filed for its own trademark on 5/7/24. These actions would not marry up with the actions of a company limping away after a beat down by the SEC. However, it does marry up to a company that is further solidifying its corporate footprint.

#7 The house just passed a bill banning the Federal Reserve from creating its own CBDC. The name of the bill is the “CBDC Anti-Surveillance State Act.”

#8 The “CBDC Anti-Surveillance State Act” starkly compliments the “End The Fed” bill that Thomas Massie put forth recently to abolish the Federal Reserve board.

More to come on the “End The Fed” bill in next week’s edition of The Fruited Plain.

#9 Meanwhile, Donald J. Trump began accepting crypto donations on or around 5/21/24 and XRP is included on that list.

#10 And finally, it was noted publicly by Trump and celebrated by the crowd in the Bronx that Ripple XRP is NOT a security.

The primary take-away here is simply this. The floodgates are about to open, financially speaking. In the end, Ripple will likely power the world’s economic system, built firmly on the foundation that the national sovereignty of each individual nation is worth protecting. A person can laugh this off or yawn a little more, but that same lackluster response will never minimize the magnitude of this story.

XRP is the bridge currency that crystallizes national sovereignty for all nations, including the USA Republic.

Watch that water!