US Securities and Exchange Commission vs Ripple Labs, LLC

What Will The "Ripple Effect" Be When All Is Said And Done?

The historic court case involving the SEC and Ripple enters into yet another phase today, 2/12/24. A remedies briefing court appearance was scheduled by Judge Analisa Torres back on 11/13/23. The two parties were ordered to complete any and all remedies-related discoveries as of today.

Ripple Vs SEC: Judge Sets Schedule For Discovery And Briefing, What This Means (11/14/23)

United States District Judge Analisa Torres has set dates for remedies discovery and briefing in the lawsuit between the United States Securities and Exchange Commission (SEC) and Ripple.

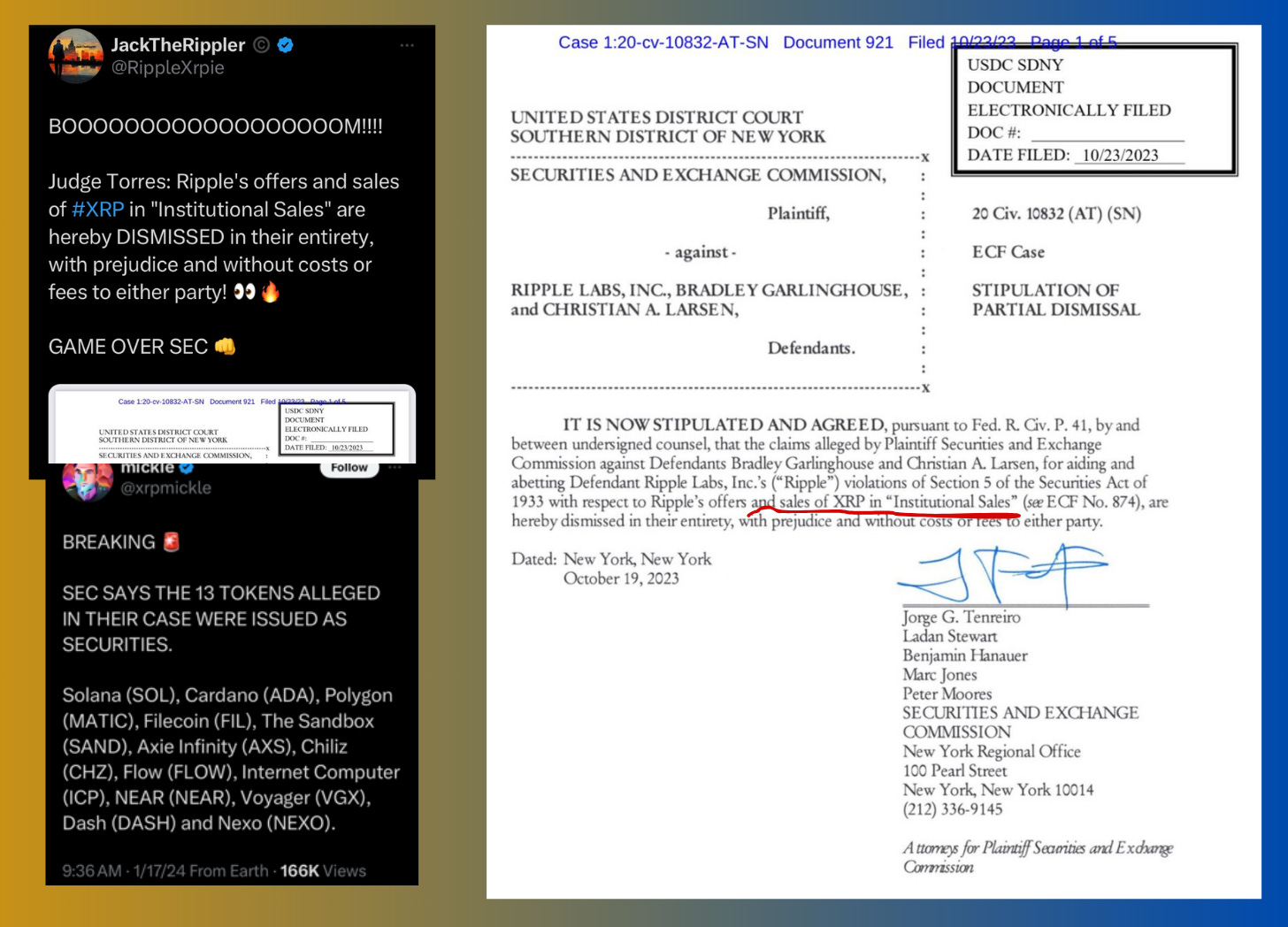

The court filing issued on November 13 was a response to the letter sent by the US SEC on November 9. The contents of the letter showed the SEC dismissing its case against Ripple’s top executives, Bradley Garlinghouse and Chris Larsen.

Judge Torres has officially signed the order for the remedies discovery and briefing and has scheduled the first court appearance on February 12, 2024. The two parties are expected to complete all remedies-related discoveries on the said date.

Much a like the tortoise and the hare, Ripple seems to be winning this “marathon race” by engaging in an incredibly slow, meticulous legal battle. The case has dragged on for over 3 years now. On 2/6/24, Ripple asked for a one-week extension and this request to push the schedule back from 2/12/24 to 2/20/24 appears to have been granted by Judge Torres.

Here is a short summary of the case filed in December 2020.

In its December 2020 lawsuit, the SEC accused Ripple of illegally raising more than $1.3 billion in an unregistered securities offering by selling XRP. The SEC has long claimed that many digital assets are securities, as are stocks and bonds, and that it has power to regulate them.

In October 2023, the court rejected the SEC interlocutory appeal relating to the “programmatic sales” ruling from July.

XRP News: Ripple’s Victory – Torres Rejects SEC Interlocutory Appeal (10/3/23)

Ripple Chief Legal Officer Stuart Alderoty had this to say about the court ruling,

“The Court’s July 13 ruling was, and remains, the law of the land. XRP is not a security.”

So does the SEC have complete regulatory authority over all cryptocurrency? Or just some, but not all? None? On 1/31/24, SEC Commissioner Hester Peirce was quoted as saying that the “…SEC will not be the primary regulator of crypto.”

Per other cases involving cryptocurrency, it appears that the SEC considers some cryptocurrency to be securities, while others are not. In regards to Ripple XRP, it is good to note that “institutional sales” of XRP were dismissed from this SEC vs. Ripple case on 10/23/23.

So if XRP is NOT a security and “institutional sales” of XRP have been dismissed from the case and the top Ripple executives have been cleared of all charges earlier, why the ongoing public display of some sort of SEC oversight that applies and/or the perceived “need” for Ripple/XRP to submit to any SEC demands?

Some people more closely connected to the many court cases involving cryptocurrency seem to think that this Coinbase case ruling will impact the next steps that the SEC has in store for this case involving Ripple/XRP.

XRP News: Coinbase Victory Could End SEC Plans to Appeal XRP Ruling (1/29/24)

Who knows, right? Speculation is speculation.

Meanwhile, Janet Yellen is urging Congress to pass cryptocurrency legislation, namely crypto assets that are NOT securities, and Jerome Powell is indicating that the Federal Reserve System (1913-2024) is investing heavily in a new “settlement system.”

Here is what is supposed to be happening next, assuming the delayed proceedings on 2/20/24 produce yet another collective yawn, in legal terms.

On March 13, the filing stated that the plaintiff will file its brief in accordance with the remedies, while XRP the defendant will file its opposition on April 12. The court case will then move on to April 29 where the Plaintiff would be allowed to file a response to the defendant’s opposition.

Does this all sound like a bunch of hooey? Why the need for such a long, drawn out legal battle? And when you take into account that XRP was NOT deemed a security months earlier, it seems even more like political theater. But why?

Meanwhile, the rest of the world is eagerly joining BRICS with Ripple XRP taking the global stage as the world reserve currency.

BRICS: Africa to Ditch US Dollar as World Bank Fails To Provide Funds? (1/26/24)

With Saudi Arabia and UAE joining BRICS officially as of 1/31/23, it is hard to pass over the fact that both countries are several years down the road with Ripple XRP, incorporating it back in 2018 and 2021 respectively.

Saudi banks just began trading oil using XRP, while Japan recently announced that all banks in Japan will be using XRP by 2025.

Ripple Purchases Oil Using XRP Unveils a $500 Trillion Market Opportunity (2/4/24)

Plainly stated, Ripple’s impressive international partnerships make the relative silence in the US market even more mysterious. The silence seems to be driven by this long, drawn out legal battle with the SEC.

Again, why do you think it would need to appear to the US public that the SEC is extraordinarily determined to stop the advancement of Ripple XRP in the US?

Ripple vs. SEC: District Court Delivers Game-Changing XRP Ruling (2/6/24)

And what is the response from Ripple in regards to US business activity? Ripple is already working with many of the largest banks in the world so CEO Brad Garlinghouse does not seem too concerned about this case with the US SEC.

A company with 90% of its business secured outside the US with the likes of Japan, Saudi Arabia, UAE, and other countries does not seem phased by the ongoing legal assault by the US SEC.

In addition, the implementation of “building” and “growing” initiatives in the US does not sound like a corporate management team that is deeply concerned about the SEC or really phased at all by the most recent court rulings.

In addition, it sounds like Ripple has money transmitter licenses (MTLs) in place already in 34 states.

Think of each state as its own country and some do not require MTLs. Plainly stated, Ripple is poised to conduct business in the US with just a minimum of 8 or maximum of 15 MTLs left to secure in certain states. Translation: The ball is clearly rolling forward for XRP in the US market, at least in the “institutional sales” space.

In the end, what will the “Ripple effect” be with all of this? Is a whole new financial world opening up with Americans sitting in the back of the bus, unable to see what is coming?

We will all have to just continue to wait and see as the never-ending case of the US SEC vs Ripple inches forward.